Why Do They Rank Series – Loans, Personal Loans, Debt Consolidation Loans

In our Why Do they Rank segment we will be looking at different categories and explaining why the current websites are ranking organically in the top three positions on Google. We will also break down what you can do to compete.

Rankings will fluctuate and change depending on Google algorithm updates, location, device and more. The brands that we analyze are who is currently ranking. The pages that can take their place will have the same SEO fundamentals covered.

This month we will look at loans, personal loans and debt consolidation loans.

TLDR – Summary

- Basic SEO: All sites that are ranking in the top three positions on Google have the basic technical optimizations done to give them the foundation to rank. Their target keyword is in the URL, meta title, meta descriptions, H1, on-page copy and more

- Authority: All of the sites have high domain authority with backlinks toward the pages that are ranking well.

Table of Contents

The SEO Basics Are Needed to Rank in the Loans Category

In general all of the brands that rank have pages where the basic SEO requirements are met to give the page the foundation to rank.

The word loan is in the following places:

- Meta title: The keyword loan is in the meta title

- Meta description: The keyword loan is in the meta description

- URL: The keyword loan is in the URL

Getting this right is an important foundational step to allow your pages to rank.

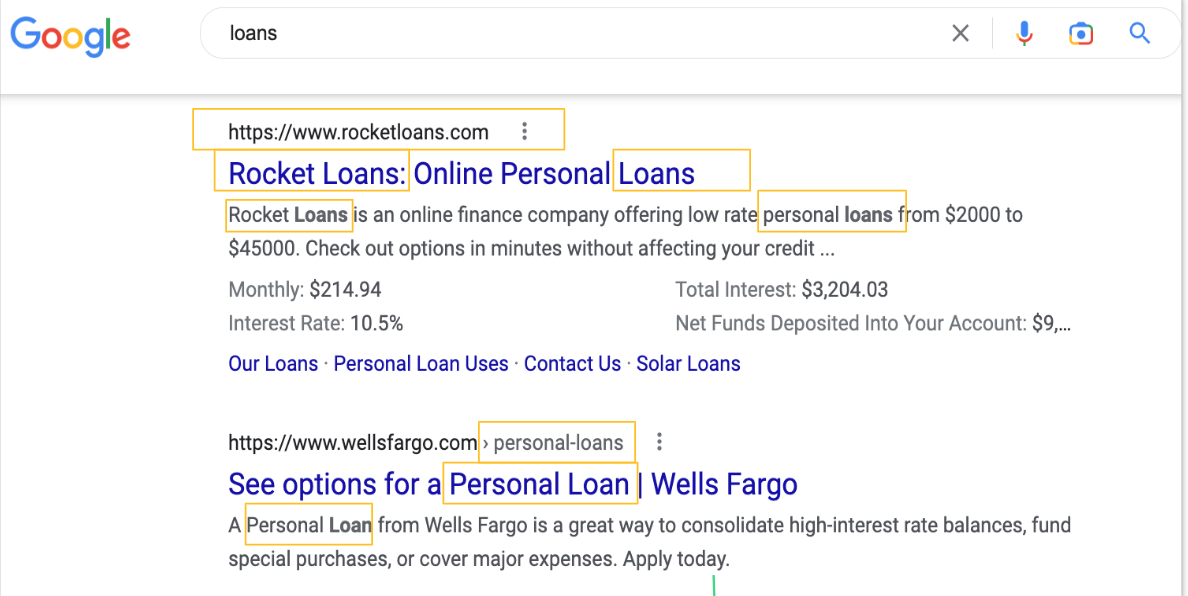

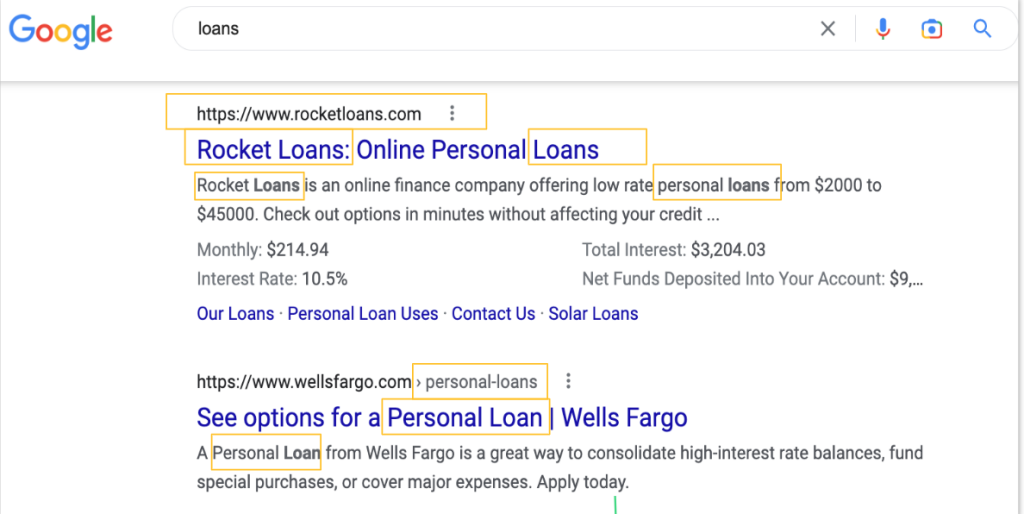

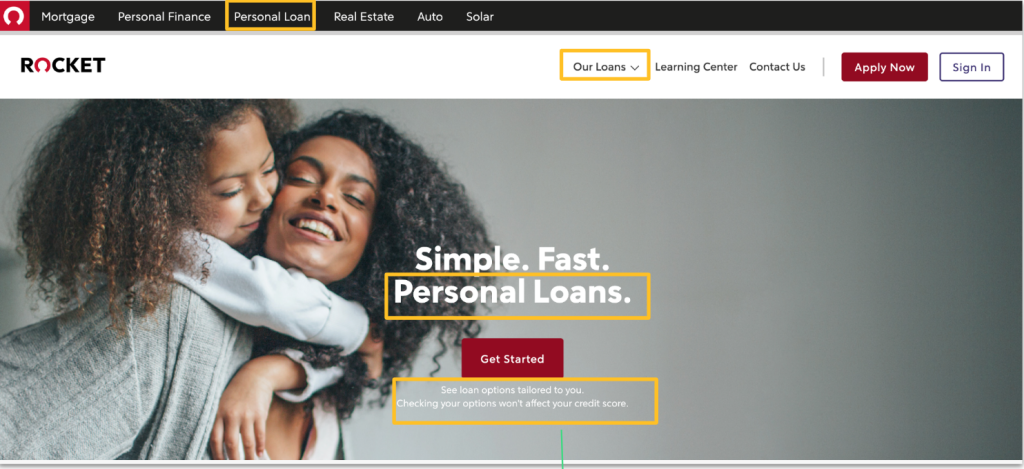

RocketLoans on page optimizations.

.

RocketLoans also has great on-page optimization further supporting the meta titles, descriptions and URL

- Top Navigation: The loan pages and keywords are in the main navigation which passes the domains domain authority to those pages.

- H1 Tag: The main Header tag has a loan keyword in it.

- Copy: The on page copy has loans on it

Let’s take a look at each of the loans and break down why the brands are ranking and what you need to do to rank as well.

Target Keyword:

- Loans

- Personal Loans

- Debt consolidations loans

How to Use SEO to Rank for Loan Terms

Monthly Search volume: 301.0K

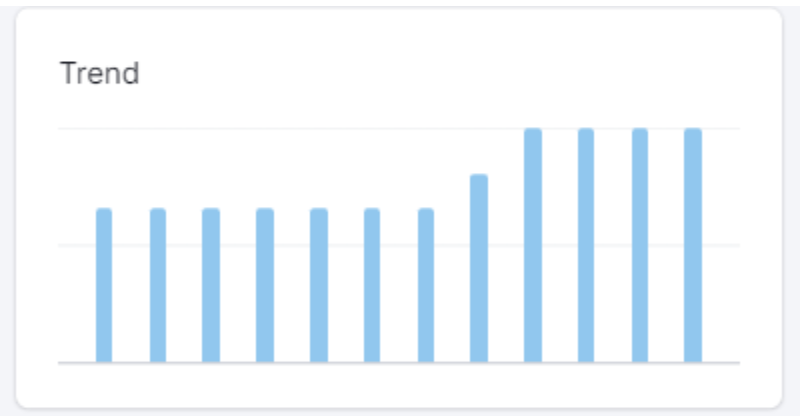

Trends:

Cost Per Click: $4.81

Who ranks:

- Position 1: SBA https://www.sba.gov/funding-programs/loans

- Position 2: RocketLoans https://www.rocketloans.com/

- Position 3: Earnest https://www.earnest.com/personal-loans

Why is this an important keyword?

Ranking organically for loans as a keyword would be an incredible achievement for any brand.

The term “loan” has enormous search volume and conversion intent. If you rank well for this term it will be easier to rank for other terms within the loan category.

What is happening in current events in the loan space?

A lot of talk in the loan space focuses on the Public Service Loan Forgiveness, as the beta version of the applications website for Biden’s student loan forgiveness opened last Friday, October 14. Qualifying borrowers can now submit an application for loan forgiveness – up to $20,000 for Pell Grant recipients and $10,000 for federal loan holders – through the federal website. The “student debt” keyword has seen a massive spike in Semrush

Big banks like Bank of America are reporting drops in profit due to big loan-loss provisions to cover the bad loans due to a deteriorating economy.

There’s a lot of interest in mortgage loans as the average rate on a 20-year HELOC (home equity line of credit) hit a new high of 8.89%

Why Do They Rank?

Here are the reasons why the websites in the top positions rank for the “loan” search term.

Why SBA.GOV ranks in the top three positions for “loans”: SBA is a .gov site, and there’s nothing more authoritative than the government. As a .gov site, it is considered a high authority, trustworthy site that offers a loan program. You can still out rank government websites however this is one of the main reasons this site is ranking so well for the term. The site also has a lot of links and content on loans especially for small businesses. Having other content on the topic of “loan” helps show the search engines that this site is an authority on finances and should rank for the word “loan”.

Why RocketLoans.com ranks in the top three positions for “loans”:

RocketLoans has a very high page authority score of 75. Its homepage has 13K backlinks, while the whole domain has 45.3K backlinks. Its Learning Center (blog) has significantly contributed to the site’s trustworthiness and authority levels, in addition to helping boost the number of backlinks. RoketLoans.com also has the word “loan” in the domain name. This makes it easier to rank for all loan related terms. This is not an exact match domain which Google stopped ranking well, but is a great thing to think about when launching a new product or site. If you want to make it easier to rank for a term, include it in your domain name. Having Growth and Skills in our domain name growthskills.co sets us up well to rank for growth marketing terms and skills related learning terms which support the two parts of our business. Growth Marketing consulting and Learning IQ sales and marketing skills training.

Earnest ranks in the top three positions for “loans”: Almost 20% of its referring domains have authority scores of 60 and up. These links from trusted sources such as Harvard.edu (due to the Earnest Scholarship they are offering to Harvard students), Time.com (inclusion in the list “The Best Student Loan Refinancing Lenders of October 2022”) all help bolster the credibility and trustworthiness of Earnest.com. They also conduct their own in-depth research that is used as reference by high authority sites, such as their study “How Much Are People Making From the Sharing Economy?” which got referenced and linked to by high-authority sites such as CNBC.com. The page that is ranking was built to target “personal loans” and ranks for “loans” and “personal loans” as a result.

How Can You Rank for Loans:

Get Backlinks from Different Domains: Work to get links from a .gov domains. Pitch your business to a local government agency. Using SEO tools, find broken links in a .gov website and offer your link as a replacement (works well with expired domains that currently are being linked to in a .gov website). You can also write a high quality article that praises one of the programs of the government agency, which may want to share your article in their news or media sections of the .gov site. You have to be specific and intentional about this outreach. If you don’t do the work to get these links then it will be harder for you to rank.

Invest in a Content Hub: Take the opportunity to develop a high-quality blog that can help boost the domain ranking of your site. You don’t have to call your content hub a blog. But you do need to commit to identifying the keywords that you want to rank for. Then building media rich articles and pages to target that keyword and all the keywords associated with it. The more useful your content is the more it will rank, the more you site visitors will engage with you and the more links you will get. This will lead to better rankings overtime.

Create Interactive Useful Content: Create high-quality content that top authority sites will be willing to link to. These pages should include elements like calculator, downloadable files for lead capture, videos and other types of media. Make sure to use this content to answer the People Also Ask questions about loans.

How to Rank for Personal Loans using SEO

Search volume: 246.0K

Trends:

Cost Per Click: $9.10

Who ranks:

- Position 1: Wells Fargo https://www.wellsfargo.com/personal-loans/

- Position 2: TD Bank https://www.td.com/us/en/personal-banking/personal-loan

- Position 3: Bank Rate https://www.bankrate.com/loans/personal-loans/rates/

Why is this an important keyword?

This is a very high-volume keyword, estimated to be about 246K searches per month in Google. For a website offering personal loans, users going to Google to search for this term are already at the stage where they want to investigate brands offering this type of loan. However, it is very hard to rank for this term.

What is happening in current events in the personal loan space?

Interest rates are rising, and the question is how will this affect personal loans and whether borrowers can still get good rates.

Also, how inflation can impact personal loan rates and borrowers

Why Do They Rank?

Authority & Branding: Wells Fargo is a well-established bank that offers personal loans – which means Google considers it a trustworthy resource. The page, while relatively sparse, contains details about the Wells Fargo personal loan product, including their rates and reasons why a user should use Wells Fargo. It ranks in 11.9K keywords and attracted 6.9K backlinks bringing an estimated 202.7K traffic per month according to SEMRUSH.

Basic Optimization & Authority: The page covers in-depth TD Bank’s personal loan product offering. While the page has the lowest authority score of 27 relative to the other pages in the top 10 for this keyword, the page benefits from the high authority score of the domain, which is 76. As such, while the page only has 765 backlinks, it ranks in 9.3K URL keywords.

Updated Content & Keyword Targeting: This BankRate page has been in existence for about 2018, with the content updated on a monthly basis. The content focuses on an extensive collection of personal loan rates from various organizations, which is of high interest to users searching for personal loans. The page has accumulated 10.6K backlinks ranking in 3.1K keywords.

How Can You Rank For Personal Loans

Authority & Trust: Trust and authority are critical reasons for ranking in the “personal loan” space, hence banks are getting to the top for this search term. To rank high, it is imperative that methods to improve the domain and page authority scores are taken. The first step is to analyze your backlinks and find sites that would be willing to link to the content that you have. Then create useful content that others will want to link to, while making sure that the site structure is optimized.

Always on Backlink Program: Domain and page authority decay over time. So you have to have an always-on approach to securing links to your website. You should also think of partner websites that you can leverage to rank. Getting links from partners is a good way of doing this fast. If you have investors, are owned by a holding company or have vendors that may be willing to add you to their website or article with a link is a great way of growing your domain authority.

Content, Content, Content: Given that “personal loan” is an ever-changing market, think of creating high value content that can be updated regularly that users want to return again and again. Make sure you answer these questions in your articles or page.

Debt Consolidation Loans

Search volume: 18.1K

Trends:

Cost Per Click: $30.86

Who ranks:

Position 1: Wells Fargo https://www.wellsfargo.com/personal-loans/debt-consolidation/

Position 2: Lending Tree https://www.lendingtree.com/debt-consolidation/

Position 3: Lending Club https://www.lendingclub.com/loans/personal-loans/debt-consolidation

Why is this an important keyword?

According to the Feds https://www.federalreserve.gov/releases/g19/current/, consumer debt in 2021 hit more than $1.04 trillion in 2021, with credit card debt about $14.6 billion. Debt consolidation is a common method for paying off debts, there is a significant number of debtors who are not fully aware of the benefits of debt consolidation or do not know how to. As such, there is massive opportunity in this space

What is happening in current events in the Debt Consolidation loans space?

With the Biden student loan forgiveness, the question arises whether now is the time to do debt consolidation and why.

President Biden also signed the legislation from U.S. Sen. Mark R. Warner (D-VA) on Oct 12 to provide much-needed relief for individuals who previously consolidated their student loan debt with a spouse. Now law, the Joint Consolidation Loan Separation Act will provide a much-needed fix for borrowers who previously consolidated their student debt with a spouse. Previously, borrowers were prevented from severing their debts — even in cases of domestic violence, economic abuse, or divorce — and excluded them from access to debt relief, such as Biden’s student loan forgiveness plan, Public Service Loan Forgiveness or payment programs that lower monthly payments based on income.

Why Do They Rank for Debt Consolidation?

Brand Credibility: Wells Fargo is a well-established bank that Google sees their offerings as credible and trustworthy.

Detailed Content: Lending Tree has become the go-to place for those looking to compare the various debt consolidation loan providers. The page has a detailed comparison table showing the important factors in choosing a debt consolidation provider such as APR range, loan amount, credit required, origination fee, and repayment terms. It also allows users to see their personalized results while providing solid leads to these loan providers.

Content, Content, Content: Lending Club has a comprehensive page allowing users to learn more about debt consolidation including reasons for consolidating debt, frequently asked questions and links to their blog showing in-depth articles. It allows users to check their rate, while showing testimonials about the impact of their services – helping it build trust among users and search engines. The page benefits from the overall authority score of the domain: while the page only has an authority score of 33, the site’s homepage has 66.

How Can You Rank for Debt Consolidation:

Authority and Trust: Focus on building authority and trust. If you have a physical location like Wells Fargo bank, be sure to include that in your site as it gives validation that your business exists and you are serving real customers. Strive to improve user experience and engagement, monitoring how users use the site, how long they stay, how many pages they visited on the site – which are all metrics to help build a trustworthy site. Focusing on local SEO to help your local pages rank will help your non-local pages rank for the target words as well.

Helpful Content: Those searching for loans are looking for guidance to help them decide the best loan providers for them. This is the type of content that users are looking for in this industry.

Social Proof & Testimonials: Build trust in your offerings. Use customer testimonials on your page. In fact, LendingClub has a dedicated page for customer reviews, where users talk of the ease in using their offerings and verifying the authenticity of their services. Help users understand more about the products using FAQs and a blog. Answer all the questions on People Also Ask and more.

Summary

That concludes this month’s segment on Why Do they Rank. The common themes for ranking well on these loan terms are.

- You have to have the SEO basics covered

- You have to build your domain and page authority with backlinks

- You have to have very informative content that answers the questions that people are asking about loans.