Brands need Growth Marketing to:

Increase Awareness, Leads and Sales

Lower the Customer Acquisition Cost (CAC)

Increase the Customer's Life Time Value (LTV)

Consumers use Search Engines, Social Media sites and Email when buying

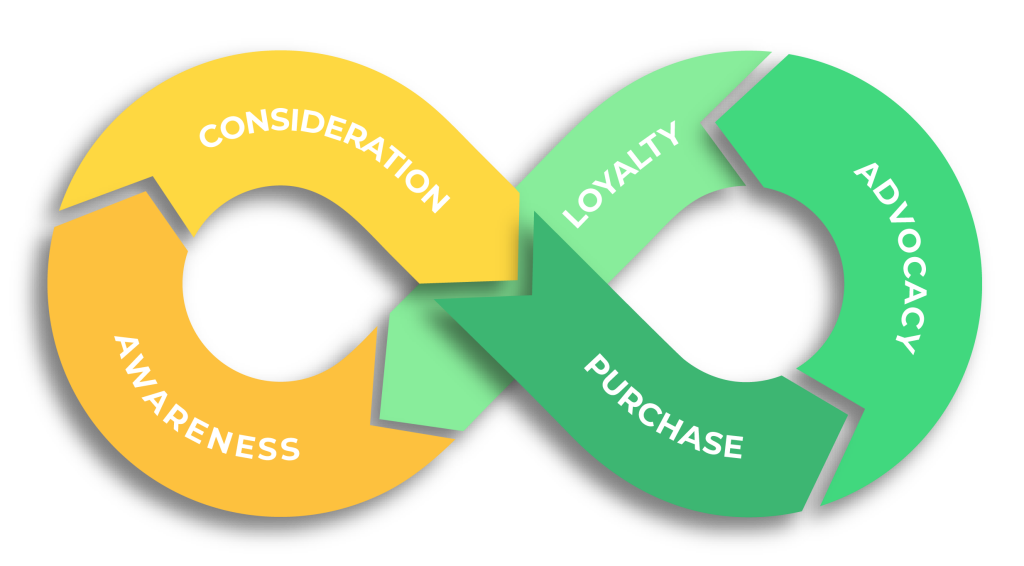

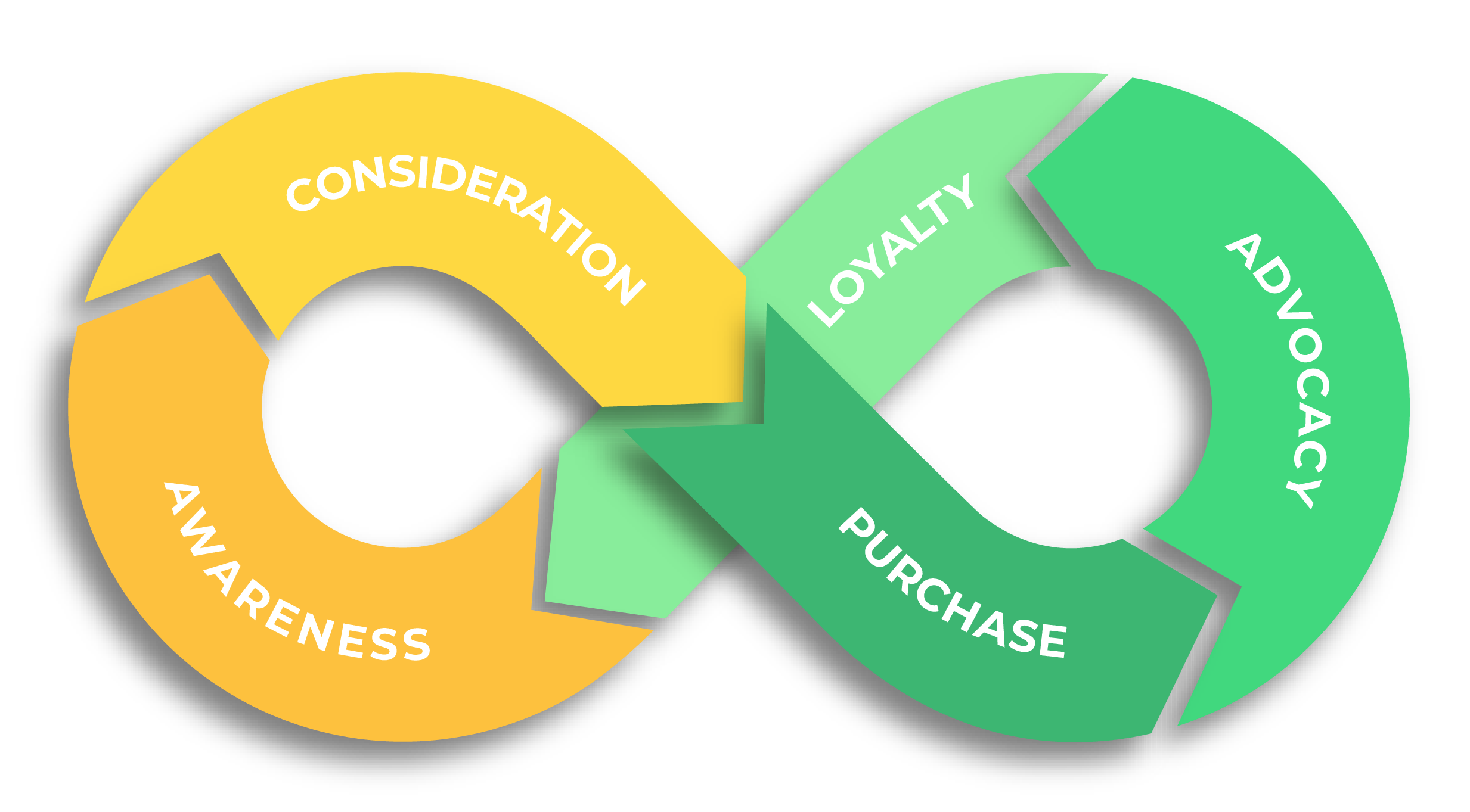

Growth Marketing connects brands to the consumer path to purchase and loyalty loop

Stimulus: Some type of stimulus happens to trigger a customer need for a product or service. This can be a life changing event, a TV commercial or a conversation with a friend.

Consideration: Once the stimulus happens the consumer will use search engines and social sites to learn more about products and services before taking an action like buying. Growth Skills uses SEO, Content and paid search and social to make sure they find your website or app.

Purchase: The consumer will take an action like trying, buying, doing something; if the content around your product or services is good. Growth Skills uses SEO to make sure your content is converts people into leads or customers.

Advocacy: If your product or service is good people will be willing to tell the world. Growth Skills uses email marketing to encourage your customers to leave a review and rave about their experience on social media.

Loyalty: If a customer loves your brand they will buy more. Growth Skills use email marketing and Customer Relationship Management (CRM) to nurture loyalty, build a relathionship, and increase the amout your customers buy from you over time.

Awareness: Brands need to increase awareness to attract new customers and keep old customers coming back. Growth Skills use Content Marketing to help brands always stay top of mind and ranking on search engines for more and more relevant terms.

That's Why we Specialize in

The Elements of Growth Marketing

Analytics & Reporting

We define AXR as the collection, reporting, and analysis of data with the goal of identifying opportunities for optimization.

Search Engine Optimization

The process of increasing the quantity and quality of traffic, leads and sales to from your website organically (i.e. without paying for ads) by making it more understandable and referenceable to search engines.

Paid Search

The practice of paying search engines to display your website on their search engine results page (SERP) when a particular keyword or group of words is searched for.

Paid Social

The practice of paying social media companies to display your advertisement to their users who fit a target demographic.

Email Marketing

The process of designing and distributing strategic marketing content to prospective and existing customers through email.

Content Marketing

The process of researching, creating, publishing, and/or distributing valuable and relevant information for a target audience.

To Deliver

The right message

At the right time

On the right channels

Watch Our Case Study Videos

The Statistics Speak for Themselves

9 OUT OF 10 CONSUMERS BEGIN THEIR ONLINE EXPERIENCE THROUGH A SEARCH ENGINE.

99% OF CONSUMERS CHECK THEIR EMAIL EVERY DAY.

MARKETERS THAT COMBINE ORGANIC SEO AND PPC ADS SEE 25% MORE CLICKS AND 27% GREATER PROFITS.

EMAIL GENERATES $38 FOR EVERY $1 SPENT, WHICH IS AN ASTOUNDING 3,800% ROI, MAKING IT ONE OF THE MOST EFFECTIVE OPTIONS AVAILABLE.

81% OF CONSUMERS’ PURCHASING DECISIONS ARE INFLUENCED BY THEIR FRIENDS’ SOCIAL MEDIA POSTS.

CONSUMERS ARE 71% MORE LIKELY TO MAKE A PURCHASE BASED ON SOCIAL MEDIA REFERRALS.

74% OF SHOPPERS MAKE BUYING DECISIONS BASED ON SOCIAL MEDIA.

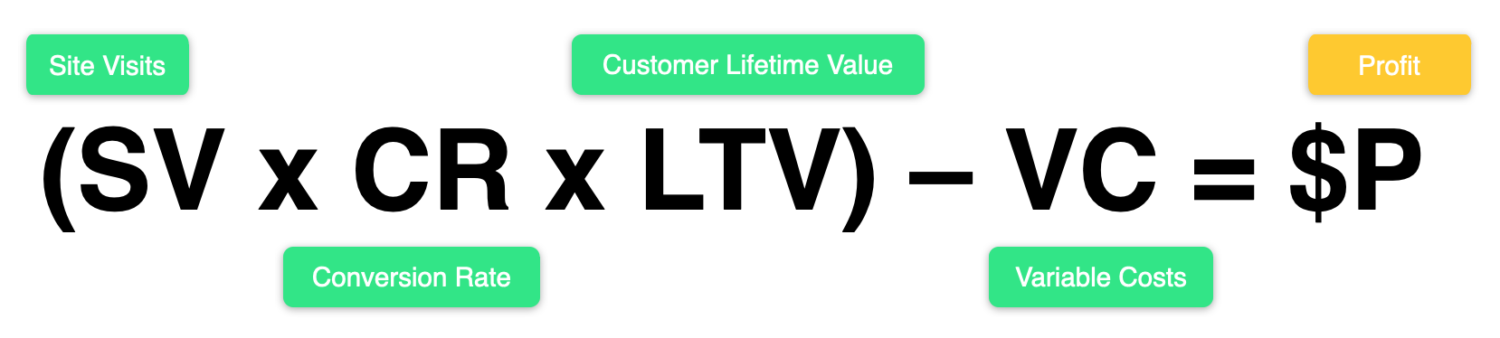

Using Proven Formula For Success

Profit Optimization Formula

We use SEO, Content Marketing, Paid Search and Paid Social to increase website traffic. We make sure consumers find your products and services when they are considering who to buy from.

We use Email Marketing and CRM to build a relationship with your customers and increase how much they buy. We focus on increasing average order value (AOV), purchase frequency, and more.

Our SEO process focuses on optimizing your pages to improve your conversion rate. This will turn the site traffic into leads or sales.

We use monday.com to integrate projects and workflows. This helps us save money by reducing your technology stack and running eveything from one place.

This leads to a great return on your marketing investment and a clear method for generating sales and revenue.

Why is Growth Marketing better?

Performance Marketing vs Growth Marketing

Performance Marketing focuses on getting a customer. It stops there.

Growth Marketing gets you a customer, then works to increase the value of that customer over time.

Growth Marketing Tackles Problems Like:

Churn

High customer acquisition cost

Cross selling

Product adoption

Life cycle product marketing

Viral loops and more

Globally Recognized, Award Winning Performance

Interested In Growth Marketing?

Fill out the form below to get in touch with a member of our team.

Growth Skills is a certified Minority Business Enterprise (MBE).

Want to Learn Growth Marketing?

Check out Learning IQ:

We’ve built a world class training platform to teach you the skills you need to grow your career.

Free Microlessons

Subscribe and get access to free micro-lessons on sales and digital marketing.

SEO Certification

Learn how to do SEO & Content Marketing. Join our certification program.

Single Courses

Buy singles courses to develop the specific skills that you need. These come with templates.

Protégé+ Program

Our six month Protégé+ program gives you paid projects as you learn and then finds you a job.